The smarter way to buy your first or next home

Not enough savings or equity to get a mortgage or trade up to your next home?

Mortgage Alternative (a bridge to a mortgage) can help you get on or up the property ladder with no debt, for a lower deposit and without mortgage insurance up front.

If you’ve started saving for a deposit for your first or next home, you know just how long it can take! But what if you could purchase your new home now, with as little as 4.5% up front including stamp duty and still avoid mortgage insurance?

With Mortgage Alternative, you can!

Mortgage Alternative, or ‘MA’ to us, is a safer, smarter way to buy a home: it’s a bridge to a mortgage.

You buy your home with a contract of sale now, at a pre-agreed fixed price that you lock in today, but with a delayed settlement of up to ten years. You can occupy the home immediately following the exchange of contracts. During the settlement period, you make monthly payments which cover your deposit instalments, rent, rates, agreed property maintenance and building insurance. Most importantly it includes a contribution to a savings account in your name to build equity. Excluding the savings component, the monthly payment is similar to a mortgage repayment plus property ownership costs.

The key to MA is that the deferred settlement (to a time of your choosing, within the maximum lease/occupancy period) gives you time to build equity in the property and savings, which should enable you to avoid mortgage insurance when you eventually settle on the property, most likely with a conventional mortgage, at the end of the maximum lease/occupancy and extended settlement period – which is up to ten years, aimed at giving you plenty of time to ride out any cycles in property prices, if needed.

Of course, you can settle earlier, if you are in a position to meet your settlement obligations – and that may mean paying for some mortgage insurance at that time, if your accumulated equity and savings at that time are not at least 20%. It’s your choice as to when you choose to settle, within that maximum time (lease) period.

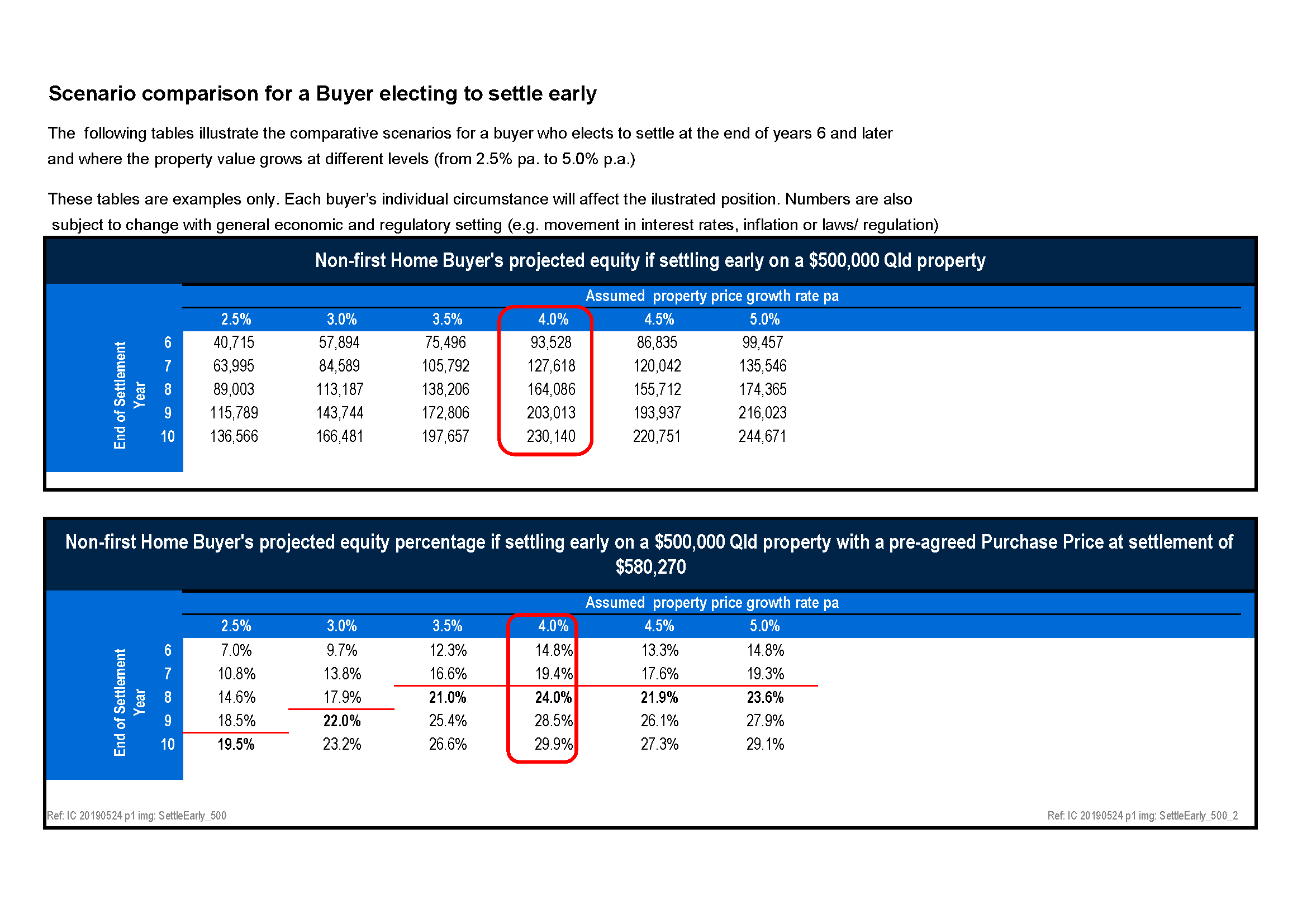

With Mortgage Alternative, how much equity will I have at settlement, if I choose to settle earlier than the maximum ten year occupancy period provided?

Check out the table below, which highlights projected MA buyer equity from year 6 onwards, where property prices grow at different average rates over the occupancy period to settlement that you choose.

For example, MA buyer equity in the property of 14.8% is projected by end of year 6 on the assumptions stated and average 4% pa growth in property prices, if you elect to settle with a mortgage at that time.

Who are the sellers?

Known as Assquire investors, these pre-approved sellers are specifically looking to sell their properties to MA buyers, as they are wishing to sell and lease their properties within a ten year period, to reap the benefits sooner. Their properties include new and established properties, as well as ‘off the plan’ homes from builders.

Assquire investors have a minimum 20% equity in their properties to safeguard and incubate credit worthy home buyers into their new or established home sooner. Parents or grandparents or friends using Assquire Family, also require the minimum equity of the Assquire investor parent of 20% and that can sometimes be achieved with a “cash out” loan against their own property, so talk to your mortgage broker or lender of choice, if that may be an option for you.

Home buyer adult children only require a minimum of: 4.5% savings (exact amount varies from State to State).

If you are interested in Assquire Family, go to the link above or look at this Linked In post, where we talk about people getting into their homes in their 20’s and 30’s, instead of in their 30’s and 40’s.

What’s more, if you’re a first home buyer, you can enjoy a grant of up to $55,000, embedded into a reduced purchase price on settlement – and it’s available on both new and existing homes, with or without Assquire Family.

Halving deposits for owner occupier home buyers is what we do – view here for a LinkedIn post on the subject.

The smarter, safer way to home ownership

Buyers require just 4.5 - 5% up front

This includes any stamp duty. There’s also no mortgage insurance to pay up front, as a mortgage isn’t required until settlement in up to ten years’ time

Straight forward qualifying criteria

Similar to a mortgage, buyers will be credit-checked against strict criteria and will need to earn an above average salary. MA is available only to owner occupiers

First home buyers' grant

MA provides first home buyers with a grant of up to $55,000 embedded into a reduced purchase price on settlement – and can be used for new and existing properties

Pre-approved properties available

You can find your own property to purchase or you can search pre-approved new and established homes on our property listing website www.BuyOrInvest.com.au.

We also have builders with new properties available both off the plan and as completed stock ready for you to move in

Move in on the exchange of contracts

Move into your home today while you pay your full deposit progressively, so that you can settle with a conventional mortgage at settlement (a time of your choosing) within ten years

Monthly payments

Your payments cover deposit instalments, rent, rates, agreed maintenance and building insurance plus a contribution to a savings account in your name to build equity and ideally avoid mortgage insurance on settlement

Superior property maintenance

During the settlement period, you’ll lease the property from the seller, meaning the seller will be responsible for all maintenance – efficiently and quickly!

Settle any time within 10 years

Get a promotion or inheritance and want to settle earlier than ten years? Absolutely! Likewise, if life changes for the worst, you can exit the contract under pre-agreed conditions without having to endure a ‘fire sale’

Learn how to become an MA buyer

We’ll explain the steps involved so you are ready to go!